Rivian Automotive Inc. (NASDAQ: RIVN), an electric vehicle (EV) company, has garnered significant attention in the financial markets, especially on platforms like Stocktwits. As investors and enthusiasts gather to discuss its stock performance, potential growth, and market trends, StockTwits has become a key hub for sharing opinions, predictions, and real-time updates on rivn stocktwits.

What is Stocktwits and Why is it Important for RIVN Investors?

StockTwits is a social media platform designed for traders, investors, and financial professionals to share insights, news, and opinions about various stocks, including rivn stocktwits. It provides a unique combination of real-time market data and user-generated content, which allows users to track sentiment and market movements.

For RIVN stockholders, StockTwits has become a vital tool for tracking investor sentiment, staying up-to-date on company developments, and discussing market trends in real-time. The platform’s ability to provide a collective voice on stock movements makes it an essential resource for anyone looking to understand the buzz around Rivian.

Rivian’s Impact on the Electric Vehicle Market

Rivian has positioned itself as a significant player in the rapidly growing electric vehicle market, competing with companies like Tesla, Ford, and General Motors. Since its IPO, Rivian has attracted substantial attention due to its innovative vehicles, including the all-electric R1T truck and R1S SUV, and its partnership with Amazon to produce electric delivery vans.

Many investors on Stocktwits follow rivn stocktwits because of its potential to disrupt the EV industry. With a focus on adventure-oriented electric vehicles and a commitment to sustainability, Rivian has differentiated itself from other EV makers. Stocktwit users frequently discuss Rivian’s market positioning, technology advancements, and strategic partnerships as key factors influencing the stock’s future performance.

Key Drivers Behind RIVN’s Stock Movements

Like any stock, RIVN’s performance is driven by a combination of factors, many of which are frequently debated on Stocktwits. Some of the most common topics include:

Product Launches and Deliveries

One of the most critical factors driving rivn stocktwits price is its ability to deliver on its promises. Investors closely monitor production numbers and delivery timelines, especially for the R1T truck and R1S SUV. Delays or disruptions in these deliveries can significantly affect the stock, leading to either optimism or pessimism on platforms like Stocktwits.

Competition in the EV Market

Rivian operates in a highly competitive space, with Tesla leading the charge and traditional automakers like Ford and General Motors rapidly ramping up their EV offerings. StockTwits users often debate how Rivian’s unique focus on adventure and utility vehicles will help it carve out a niche in the broader market or whether the company will struggle to compete against more established players.

Financial Performance and Earnings Reports

Rivian’sInvestors closely watch financials, including earnings reports, revenue forecasts, and cash burn rate. StockTwits often light up around earnings season as users dissect the company’s financial performance and future outlook. Investors pay particular attention to Rivian’s ability to scale production while maintaining healthy margins.

Partnerships and Collaborations

Partnerships, such as Rivian’s collaboration with Amazon for electric delivery vehicles, are significant catalysts for the stock. Stocktwit users frequently discuss these partnerships and speculate about future collaborations that could boost Rivian’s growth. Amazon’s commitment to purchasing 100,000 electric vans from Rivian by 2030 is a recurring topic of discussion.

Sentiment Analysis of RIVN on Stocktwits

StockTwits provides a sentiment analysis feature, which tracks whether most posts about a stock are positive or negative. This can give investors insight into the broader market sentiment surrounding rivn stocktwits. A surge in positive sentiment might indicate that investors are bullish on the stock, while a rise in negative sentiment could signal concerns about the company’s future performance.

The platform’s sentiment analysis for RIVN often fluctuates based on news, earnings reports, or macroeconomic events. For example, positive news about Rivian’s production capacity or new partnerships tends to boost sentiment, while delays or financial setbacks can cause sentiment to turn negative. Investors use this tool to gauge the crowd’s mood and inform their trading strategies.

Monitoring Stocktwits for Breaking News

One key advantage of using Stocktwits to track rivn stocktwits is the speed at which breaking news spreads on the platform. Stocktwit users often share news stories, analyst upgrades or downgrades, and rumours about Rivian, providing real-time updates to the community. Many traders monitor the platform for any sign of market-moving news, which can provide a competitive edge when making trading decisions.

Key Insights and Predictions from Stocktwits Users

The discussions on Stocktwits can provide valuable insights for those looking to invest in RIVN. Users share technical analysis, chart patterns, and trade ideas, which can help both novice and experienced traders make informed decisions. Here are some key insights often shared by Stocktwits users:

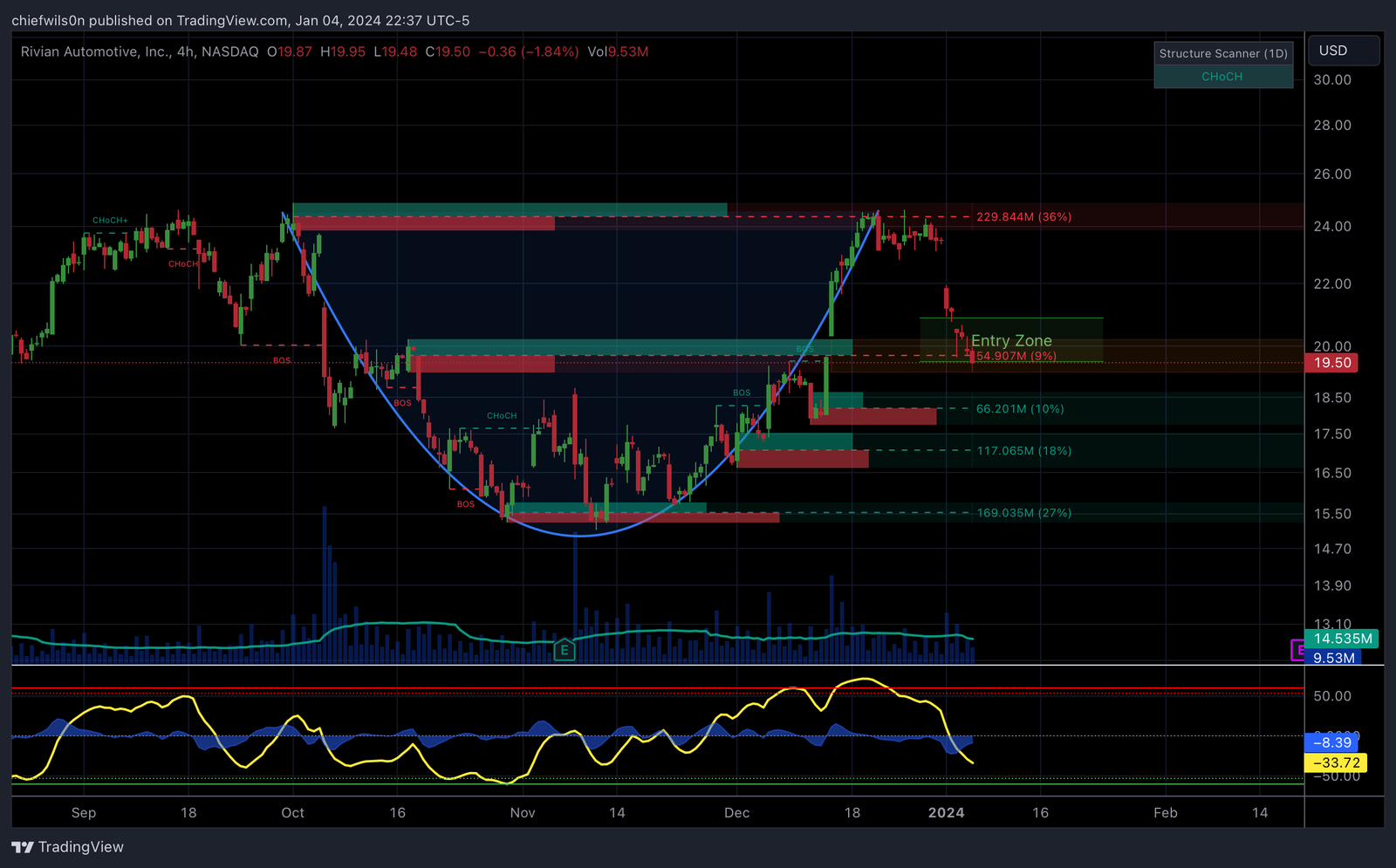

Technical Analysis and Chart Patterns

Stocktwits has a large number of users who share technical analysis and chart patterns for rivn stocktwits. Common topics include support and resistance levels, moving averages, and volume trends. These insights can help traders identify their trades’ potential entry and exit points.

Long-term vs. Short-term Sentiment

While some users are focused on short-term trading opportunities, others take a long-term perspective on RIVN. Long-term investors on Stocktwits often discuss Rivian’s potential to become a dominant player in the EV market. At the same time, short-term traders are more concerned with daily price movements and volatility. The platform provides a blend of both perspectives, allowing users to see how different groups of investors view the stock.

Comparing RIVN to Other EV Stocks

Stocktwit users frequently compare rivn stocktwits to other EV stocks, such as Tesla, Lucid Motors, and Nio. These comparisons can offer insight into how its competitors perceive Rivian and whether investors believe it has a unique advantage in the market. By understanding how RIVN stacks up against other EV companies, traders can make more informed decisions about buying, holding, or selling the stock.

Final Thoughts: Is Stocktwits a Reliable Resource for RIVN Investors?

StockTwits is a powerful tool for tracking the latest developments and sentiment around RIVN stock. However, it’s essential to approach the platform with a critical mindset. While Stocktwits provides valuable insights and real-time updates, it’s also home to a wide range of opinions, some of which may not be based on sound analysis.

For rivn stocktwits investors, the key is to use Stocktwits as one of many tools in their decision-making process. Combining the insights from Stocktwits with fundamental analysis, financial reports, and news from trusted sources can provide a well-rounded view of Rivian’s potential as an investment.

Ultimately, Stocktwits offers a unique glimpse into the collective mindset of traders and investors, making it a valuable resource for anyone looking to stay informed about RIVN stock. Whether you’re a long-term believer in Rivian’s vision or a short-term trader looking for quick profits, Stocktwits can provide real-time data, sentiment analysis, and market-moving insights to help guide your investment strategy.

.

Leave a Reply