Introduction to FBOB’s Bookkeepers

In the ever-evolving world of business, financial management remains a critical component for success. Whether you’re a small business owner, a startup founder, or an established enterprise, keeping your books in order is essential. FBOB’s Bookkeepers specialize in providing professional bookkeeping services to ensure accuracy, compliance, and financial clarity. But what exactly do they offer, and how can they help your business grow? In this comprehensive guide, we will explore everything you need to know about FBOB’s Bookkeepers.

What Are Bookkeeping Services?

Bookkeeping is the process of recording financial transactions, categorizing expenses, reconciling bank statements, and ensuring that financial records are up to date. A professional bookkeeper plays a crucial role in maintaining financial health by keeping accurate records, which are essential for tax preparation, financial planning, and business growth.

Why Is Bookkeeping Important?

- Financial Clarity: Understanding your cash flow, profits, and expenses allows for better decision-making.

- Compliance: Ensuring that financial records meet legal and tax requirements helps prevent legal issues and penalties.

- Budgeting & Forecasting: Accurate bookkeeping enables businesses to plan for the future effectively.

- Business Growth: Organized financial records help attract investors and secure loans.

FBOB’s Bookkeepers: What Sets Them Apart?

BOB’s Bookkeepers stand out from the competition due to their commitment to precision, efficiency, and customer satisfaction. Here are some key reasons why they are a top choice for businesses:

1. Expertise & Experience

With years of industry experience, FBOB’s Bookkeepers have a deep understanding of various industries’ financial needs. Their team of certified professionals ensures that every financial transaction is accurately recorded and categorized.

2. Comprehensive Bookkeeping Solutions

FBOB’s Bookkeepers offer a wide range of services, including:

- Accounts Payable & Receivable Management: Ensuring bills are paid on time and invoices are collected efficiently.

- Bank & Credit Card Reconciliation: Matching financial records with bank statements to identify discrepancies.

- Payroll Processing: Managing employee salaries, tax deductions, and benefits.

- Financial Reporting: Generating profit and loss statements, balance sheets, and cash flow reports.

- Tax Preparation & Compliance: Ensuring businesses meet tax obligations without errors.

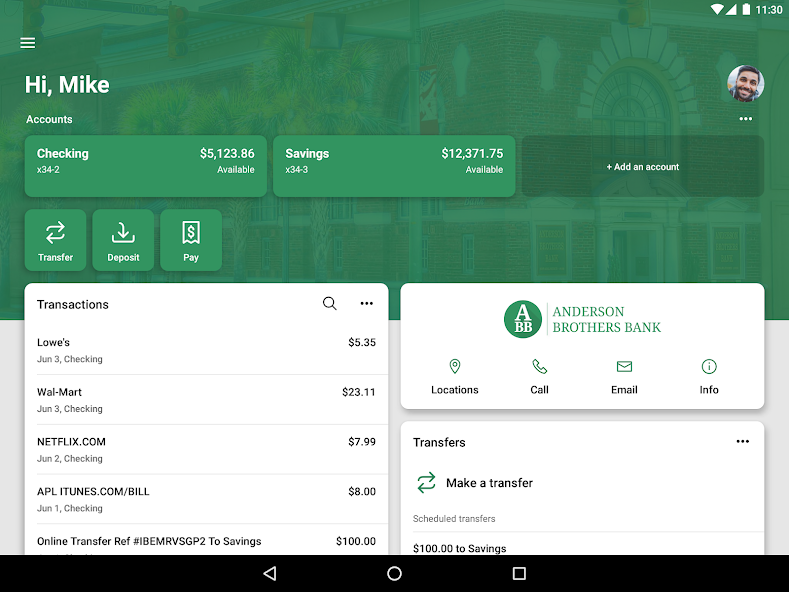

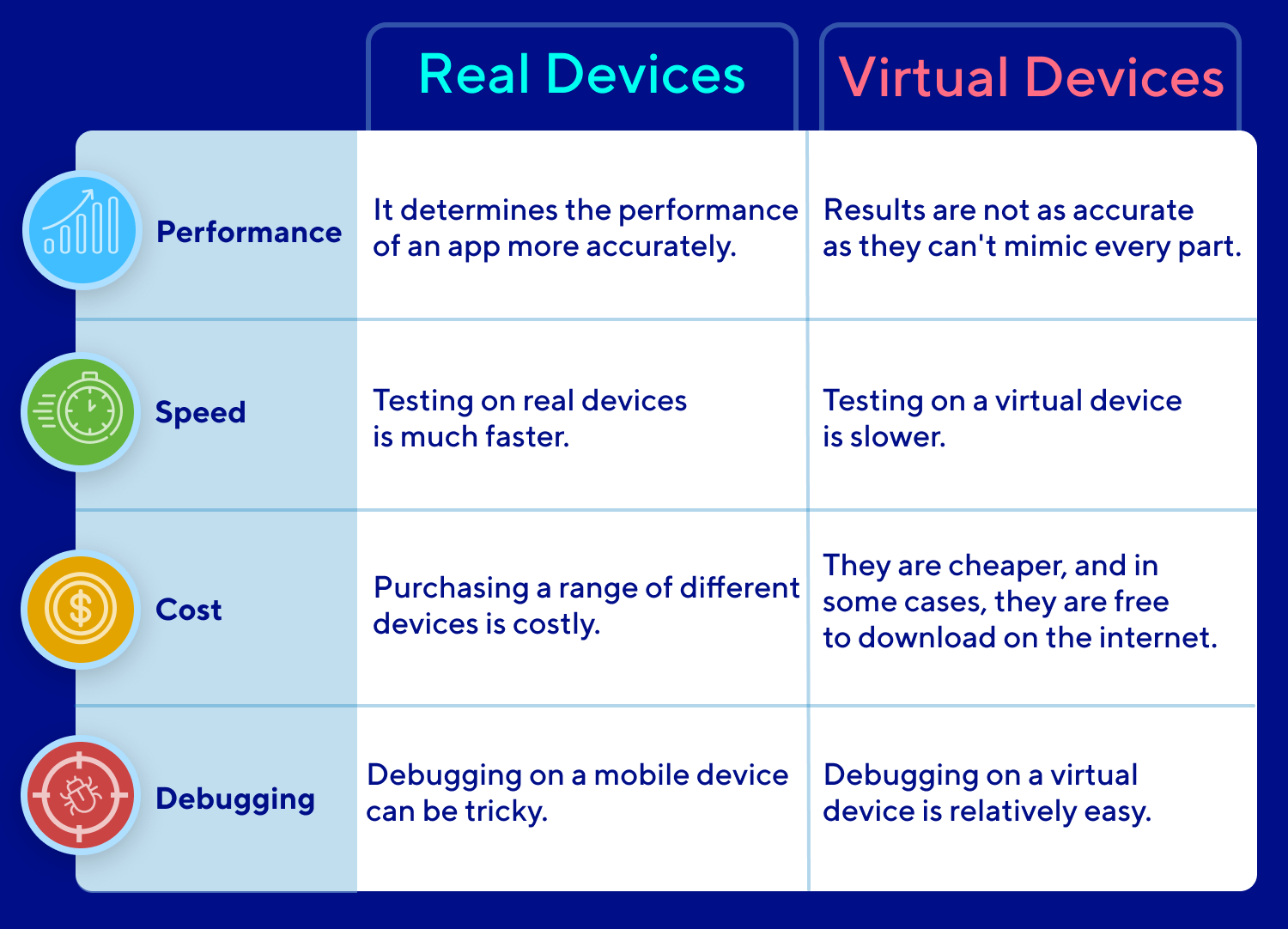

3. Use of Advanced Technology

FBOB’s Bookkeepers leverage the latest bookkeeping software, such as QuickBooks, Xero, and FreshBooks, to streamline financial processes. Cloud-based solutions enable real-time financial tracking, ensuring transparency and accuracy.

4. Tailored Services for Every Business

No two businesses are the same, and FBOB’s Bookkeepers understand that. They offer customized bookkeeping solutions to meet the unique needs of startups, small businesses, and large enterprises. Whether you need full-service bookkeeping or assistance with specific tasks, their flexible approach ensures optimal results.

5. Cost-Effective Solutions

Hiring an in-house bookkeeping team can be expensive. FBOB’s Bookkeepers provide an affordable alternative without compromising quality. Their pricing plans cater to different business sizes and budgets, making professional bookkeeping accessible to all.

How FBOB’s Bookkeepers Help Businesses Thrive

Improving Financial Efficiency

By outsourcing bookkeeping to FBOB’s Bookkeepers, businesses can save time and focus on growth. Their experts handle financial management efficiently, reducing errors and ensuring seamless operations.

Ensuring Compliance and Accuracy

Tax laws and financial regulations change frequently. FBOB’s Bookkeepers stay up to date with the latest changes, ensuring that your business remains compliant and avoids penalties.

Providing Valuable Insights

Through detailed financial reports and analysis, FBOB’s Bookkeepers help businesses understand their financial position. This data-driven approach enables strategic decision-making and sustainable growth.

Choosing the Right Bookkeeping Service: Why FBOB’s Bookkeepers?

When selecting a bookkeeping service, it’s essential to consider factors like experience, technology, pricing, and customer support. FBOB’s Bookkeepers check all the boxes, offering reliable and efficient services tailored to business needs.

Questions to Ask Before Hiring a Bookkeeping Service

- What bookkeeping software do you use?

- How do you ensure data security and confidentiality?

- Do you offer customized bookkeeping solutions?

- What are your pricing plans?

- How do you handle tax compliance and reporting?

FBOB’s Bookkeepers provide clear answers to these questions, ensuring transparency and reliability in their services.

Getting Started with FBOB’s Bookkeepers

If you’re ready to streamline your financial management, partnering with FBOB’s Bookkeepers is a step in the right direction. The process is simple:

- Consultation: Discuss your business needs and bookkeeping requirements.

- Onboarding: Set up bookkeeping software and integrate existing financial records.

- Ongoing Support: Receive continuous bookkeeping support and financial insights.

Conclusion

Bookkeeping is the backbone of a successful business, and FBOB’s Bookkeepers provide the expertise needed to maintain financial accuracy and compliance. With their tailored services, advanced technology, and cost-effective solutions, businesses can focus on growth while ensuring their finances are in expert hands.

Whether you’re a startup, small business, or established company, FBOB’s Bookkeepers offer the reliability and professionalism you need to thrive in today’s competitive market. Start your journey toward financial clarity today with FBOB’s Bookkeepers!

Leave a Reply