prince narula digital paypa, known widely in the entertainment industry, has recently made waves by stepping into the digital finance arena. His initiative, Digital Paypa, has quickly caught attention for its innovative approach to digital payments and its potential to disrupt conventional payment methods. This article delves into the vision, features, and future of Digital Paypa, along with what sets it apart from other digital payment solutions.

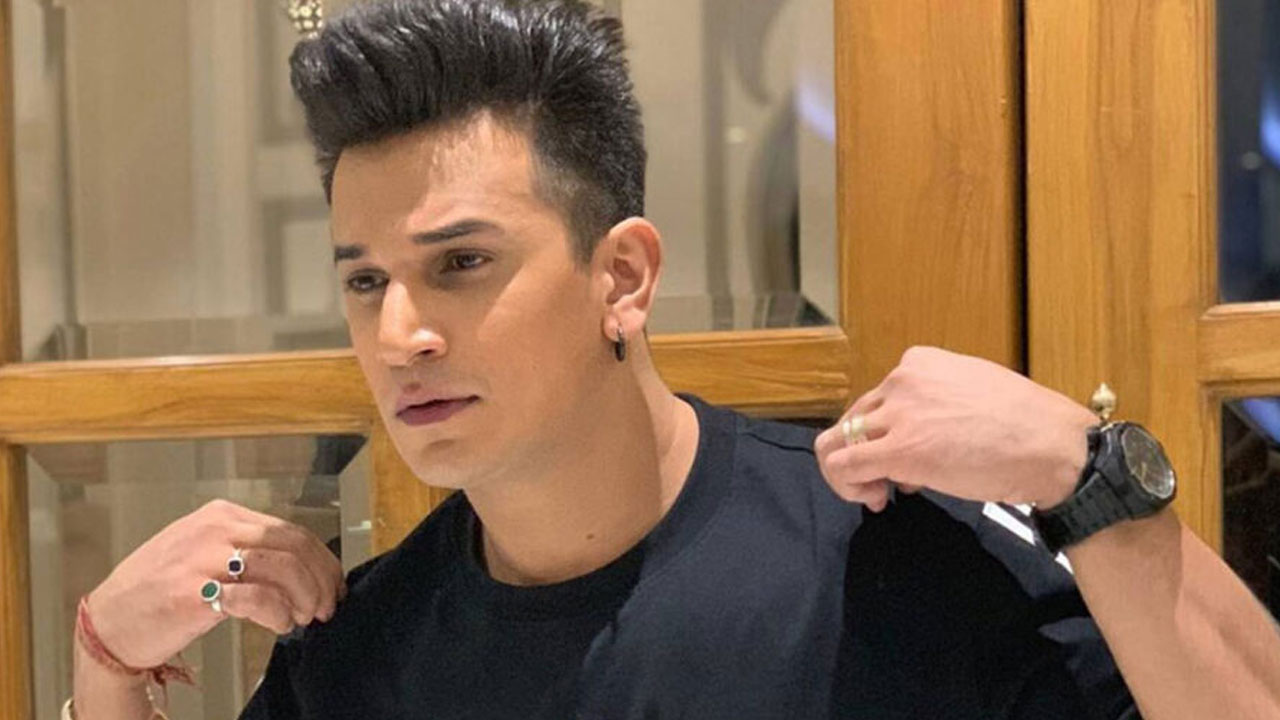

Who is Prince Narula?

Prince Narula is a prominent Indian reality TV personality, actor, and model, widely recognized for his success in shows like Bigg Boss, MTV Roadies, and Splitsvilla. Beyond his television persona, Narula has proven himself as a versatile public figure and entrepreneur. By launching Digital Paypa, he has ventured into a new domain, aiming to revolutionize digital payments and tap into the fast-growing fintech industry in India.

The Vision Behind Digital Paypa

prince narula digital paypa was founded with the vision of simplifying online transactions and making them accessible to a wider audience. His entry into the fintech sector aligns with the broader trend in India, where digital payments are skyrocketing due to a combination of factors, including increased smartphone use, high-speed internet access, and supportive government policies.

Digital Paypa aims to bridge gaps in traditional banking by offering a user-friendly, secure, and convenient digital payment solution. Narula’s vision includes reaching users in urban as well as rural areas, making digital payments accessible to everyone, from small business owners to tech-savvy millennials.

Key Features of Digital Paypa

Digital Paypa differentiates itself with several notable features that make it attractive in the digital payments market. Here are the core features:

1. Seamless Transactions

Digital Paypa was developed with ease of use as a top priority. Users can make payments, transfer money, and manage their finances with a few simple taps on their mobile device. Whether paying for goods online, transferring funds to family, or settling bills, Digital Paypa provides a smooth, user-friendly experience.

2. Enhanced Security

Security is paramount in the digital payment industry, and Digital Paypa takes this seriously. The platform uses multi-layered encryption and two-factor authentication (2FA) to protect user data and transactions. This commitment to security ensures that users can trust the app for safe transactions, a critical factor in building a loyal customer base.

3. Accessibility in Multiple Languages

Understanding India’s diverse linguistic landscape, Digital Paypa offers multi-language support. Users can choose from several regional languages, making it accessible to a broad audience across the country. This feature is particularly beneficial for users in rural areas who may not be fluent in English, as it helps them engage with digital payments confidently.

4. Rewards and Cashback Programs

Prince Narula has tapped into the popular strategy of offering rewards and cashback to encourage users to make Digital Paypa their primary payment platform. Frequent users can earn rewards or cashback, which can be redeemed for future transactions or special discounts. These incentives keep users engaged while helping Digital Paypa gain traction in the competitive market.

5. Partnerships with Merchants

To expand its reach, Digital Paypa has partnered with various local and national merchants, enabling users to pay through the platform across multiple businesses. These collaborations provide a seamless payment experience in restaurants, retail outlets, and online stores, further adding value for Digital Paypa users.

How Digital Paypa Stands Out in a Competitive Market

In an era where digital payment options abound, what makes Digital Paypa unique? The answer lies in its user-centric approach, regional accessibility, and prince narula digital paypa engagement with his audience.

A Celebrity-Driven Approach

Prince Narula’s association with Digital Paypa brings a celebrity factor that appeals to his fan base, creating a loyal user community. His public persona and popularity help build trust in the platform, setting it apart from competitors that lack a personal touch. Additionally, Narula actively promotes the platform on social media, where he engages with millions of followers, giving Digital Paypa an advantage in marketing and visibility.

Focus on User Empowerment

Digital Paypa empowers users by offering financial literacy tools and tips on using digital payment options. By educating users, especially in rural areas, the platform is paving the way for greater adoption of digital payments. The initiative aligns with the government’s “Digital India” vision, further enhancing its appeal.

Digital Paypa and Financial Inclusion in India

Financial inclusion has been a priority for India, and Digital Paypa aligns with this mission by offering a platform that is accessible and easy to use for everyone. Here’s how it plays a role in boosting financial inclusion:

Expanding Digital Payment Access to Rural Areas

One of Digital Paypa’s key strengths is its focus on accessibility, particularly for users in rural areas. With features like multi-language support, it is easy for people who may not be familiar with other digital wallets to use Digital Paypa. The app’s user-friendly interface also helps first-time users adopt digital payments with minimal learning curves.

Simplifying Transactions for Small Businesses

For small business owners, Digital Paypa simplifies the payment process by providing an alternative to cash. Through partnerships with local businesses, Digital Paypa makes it easy for them to receive digital payments, which increases their customer base and reduces dependency on cash. This shift not only benefits small businesses but also supports the overall push for a cashless economy.

The Future of Digital Paypa: Expansions and Innovations

As Digital Paypa grows, several developments are on the horizon that will further enhance the platform and solidify its position in the fintech market.

1. Introduction of New Features

prince narula digital paypa and his team have hinted at new features that will soon be introduced to the platform. These may include options like investment tools, savings accounts, and credit services, which can provide users with a complete digital finance ecosystem. Such features would make Digital Paypa not just a payment app but a full-fledged financial solution.

2. Expansion to International Markets

While Digital Paypa primarily serves users in India, expansion to other countries with large Indian diaspora communities is a possibility. Narula’s popularity and the platform’s accessibility features could attract users abroad, particularly in countries where digital payments are widely accepted.

3. Use of AI and Machine Learning for Enhanced Services

In the future, Digital Paypa may integrate AI and machine learning technologies to offer personalized recommendations to users, fraud detection, and advanced analytics. AI-driven insights could enhance the user experience by suggesting ways to save, budget, or invest based on individual spending habits.

4. Collaborations with Banks and Financial Institutions

Collaborating with traditional financial institutions will allow Digital Paypa to provide more robust financial services. Potential partnerships with banks could facilitate services like microloans or insurance, making the platform a one-stop financial solution for users.

Challenges and Opportunities for Digital Paypa

Like any new venture, Digital Paypa faces both challenges and opportunities as it seeks to establish itself in the digital payments space.

Opportunities in a Growing Market

With digital payments in India on the rise, Digital Paypa has a significant growth opportunity. By capturing market share in urban and rural areas alike, the platform could secure a loyal user base and drive digital payment adoption further.

Competition and Regulatory Challenges

The digital payment industry in India is competitive, with several established players like Paytm, PhonePe, and Google Pay. Digital Paypa must continually innovate to stay relevant and attract users. Additionally, regulatory challenges and compliance issues may pose obstacles as the platform expands, making it essential for Narula and his team to stay updated with fintech regulations.

Conclusion

Digital Paypa represents prince narula digital paypa ambitious leap from entertainment to entrepreneurship in the digital finance industry. With a vision rooted in accessibility and security, Digital Paypa is well-positioned to make a positive impact on India’s digital payment landscape. From supporting financial inclusion to empowering small businesses and offering user-friendly features, Digital Paypa has the potential to reshape how Indians handle everyday transactions. As Prince Narula continues to champion this platform, it will be exciting to see how Digital Paypa evolves, overcomes challenges, and makes its mark in the world of digital payments.

Leave a Reply